Payroll isn’t just about paying salaries on time.

It’s a business-critical operation that impacts compliance, employee trust, and financial health.

Yet many businesses don’t track payroll performance properly.

They ask:

- “Did payroll run?”

- “Did anyone complain?”

But they don’t ask the questions that actually matter.

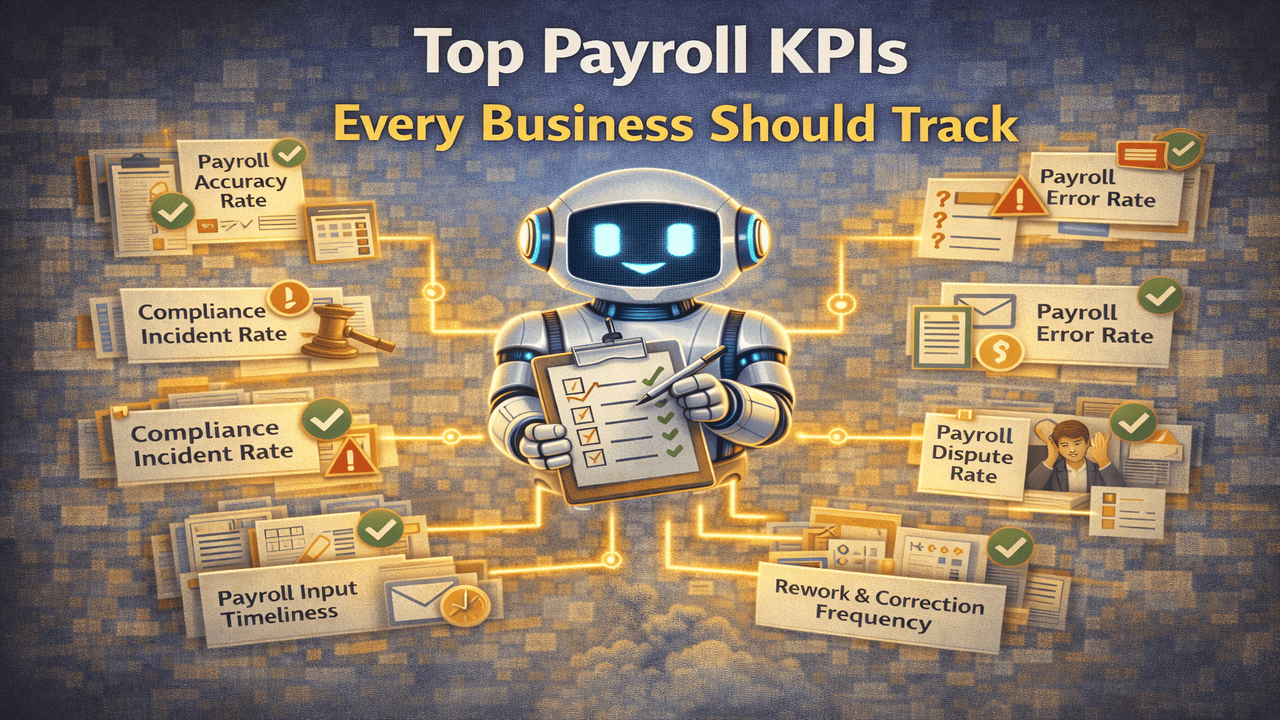

That’s where payroll KPIs come in.

🧠 What Are Payroll KPIs?

Payroll KPIs (Key Performance Indicators) are metrics that help businesses measure:

- Payroll accuracy

- Process efficiency

- Compliance health

- Operational risk

Tracking the right KPIs turns payroll from a blind process into a measurable system.

✅ KPI #1: Payroll Accuracy Rate

What it measures:

The percentage of payroll runs completed without errors.

Why it matters:

Payroll errors lead to rework, disputes, and loss of employee trust.

How to calculate:

Correct payroll runs ÷ Total payroll runs × 100

🎯 Best practice: Aim for 99%+ accuracy.

⏱️ KPI #2: Payroll Processing Time

What it measures:

How long it takes to complete a payroll cycle from start to finish.

Why it matters:

Long processing times indicate manual work, bottlenecks, and inefficiencies.

What to watch:

If payroll takes longer as your team grows, your process doesn’t scale.

⚠️ KPI #3: Payroll Error Rate

What it measures:

Number of payroll errors per cycle.

Why it matters:

Even small errors compound over time and increase operational cost.

This KPI is the mirror image of payroll accuracy — and often more honest.

🧾 KPI #4: Compliance Incident Rate

What it measures:

Number of compliance-related payroll issues (late deductions, missing documentation, audit gaps).

Why it matters:

Compliance failures can lead to penalties, legal exposure, and reputation damage.

A rising compliance incident rate is a serious warning sign.

📩 KPI #5: Payroll Input Timeliness

What it measures:

How often payroll inputs (HR approvals, sick leaves, deductions) arrive on time.

Why it matters:

Late inputs force payroll teams to rush or miss data.

This KPI highlights dependency on:

- Emails

- Manual follow-ups

- Human memory

😤 KPI #6: Payroll Dispute Rate

What it measures:

Number of employee payroll complaints per cycle.

Why it matters:

Payroll disputes directly impact employee satisfaction and HR workload.

Even if payroll “runs,” high dispute rates indicate deeper problems.

🔁 KPI #7: Rework & Correction Frequency

What it measures:

How often payroll corrections are required after payroll is processed.

Why it matters:

Rework means payroll is reactive, not reliable.

Automation should push this KPI close to zero.

📈 KPI #8: Payroll Scalability Indicator

What it measures:

How payroll workload changes as headcount grows.

Key question:

Does payroll effort grow linearly with employees?

If yes, your payroll system doesn’t scale.

🤖 Why Manual Payroll Makes KPIs Hard to Track

In manual systems:

- Data is scattered across emails

- Decisions aren’t logged

- Errors aren’t measured properly

As a result, most payroll KPIs are:

- Estimated

- Incomplete

- Ignored

You can’t improve what you can’t measure.

🚀 How Automation Improves Payroll KPIs

AI-powered payroll automation:

- Tracks every action automatically

- Logs validations and approvals

- Flags issues before payroll runs

- Provides real-time visibility

This makes payroll KPIs accurate, actionable, and reliable.

🧠 Final Thoughts

Payroll KPIs are not just numbers.

They are early warning signals.

Businesses that track the right payroll KPIs:

- Catch problems early

- Reduce risk

- Improve efficiency

- Build employee trust

Ignoring payroll KPIs means flying blind.

🤝 Track Payroll KPIs Automatically with Payroll Robot

Payroll Robot uses AI agents to automate payroll workflows and track key payroll KPIs — helping businesses reduce errors, stay compliant, and scale with confidence.

Because what gets measured gets improved.

Comments are closed