Payroll is one of those business tasks that seems simple—until it isn’t.

At first glance, running payroll manually looks inexpensive: a spreadsheet, some formulas, maybe an accountant checking things once a month. But behind the scenes, manual payroll quietly drains time, money, and trust. The real cost isn’t just dollars—it’s stress, errors, and missed opportunities to focus on growth.

Let’s break down the hidden cost of manual payroll—and how AI-powered automation finally fixes it.

The True Cost of Manual Payroll

1. Payroll Errors Are More Common Than You Think

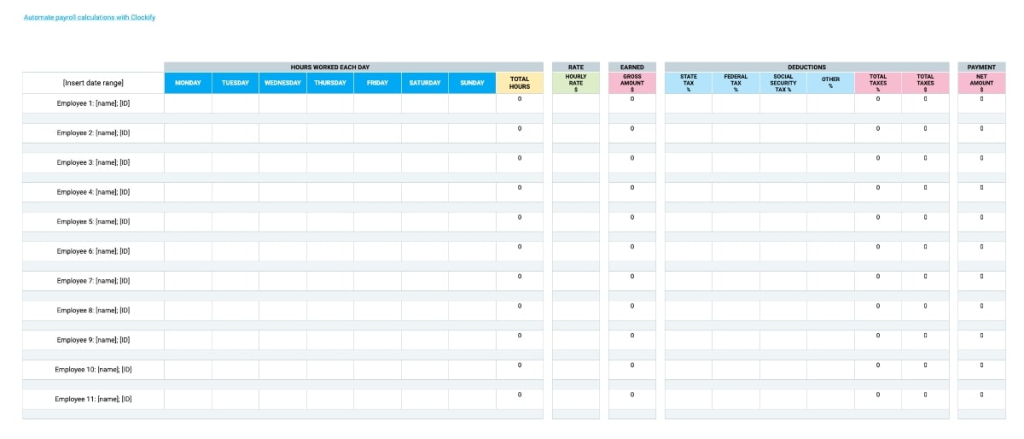

Manual payroll relies heavily on human input. Hours are typed in. Tax rates are looked up. Deductions are calculated by hand. Even the most careful teams make mistakes.

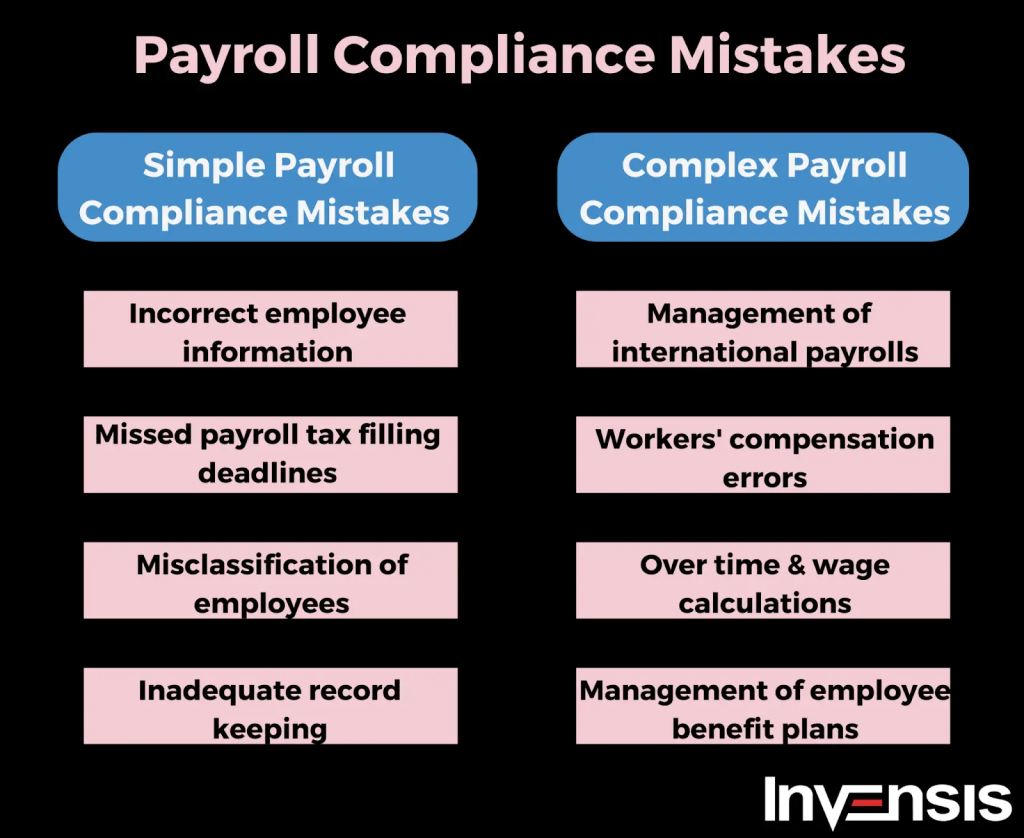

Common payroll errors include:

- Incorrect overtime calculations

- Misclassified employees or contractors

- Missed tax updates or rate changes

- Inaccurate deductions or benefits

Each small mistake compounds. A single error can lead to back payments, tax penalties, or frustrated employees wondering if they can trust their paycheck.

2. Compliance Risks Add Up Quickly

Payroll laws change constantly—federal, state, and local. Keeping up manually means tracking:

- Tax filing deadlines

- Minimum wage updates

- Overtime rules

- Employee classification laws

Missing just one update can result in fines or audits. For growing companies, compliance becomes a full-time job—yet it’s often handled part-time.

Manual payroll doesn’t just increase workload; it increases exposure to risk.

3. Time Is Your Most Expensive Resource

How many hours does your team spend every pay period:

- Collecting timesheets

- Verifying data

- Running calculations

- Fixing errors

- Answering payroll questions

Now multiply that by 12 or 26 pay cycles per year.

That’s time your finance, HR, or leadership team could spend hiring, improving operations, or growing revenue. Manual payroll steals time silently—but relentlessly.

4. Employee Trust Is on the Line

Payroll mistakes don’t just affect numbers—they affect people.

Late paychecks, incorrect amounts, or missing deductions erode trust quickly. Employees may forgive a missed meeting or delayed email, but payroll errors feel personal.

Reliable payroll isn’t just an administrative task—it’s a foundation of workplace trust.

How AI-Powered Payroll Fixes the Problem

This is where automation—and AI in particular—changes everything.

1. Fewer Errors, Automatically

AI-driven payroll systems reduce human error by:

- Pulling data directly from connected systems

- Validating calculations in real time

- Flagging inconsistencies before payroll runs

Instead of discovering mistakes after employees are paid, issues are caught early—or eliminated entirely.

2. Built-In Compliance Monitoring

Modern AI payroll tools continuously monitor:

- Tax rate changes

- Regulatory updates

- Filing deadlines

This means compliance is no longer something you “try to remember.” It’s baked into the system. The software adapts as rules change—without manual intervention.

3. Massive Time Savings

With AI-powered payroll:

- Payroll runs in minutes, not hours

- Reports are generated instantly

- Corrections don’t require manual recalculation

Teams reclaim dozens of hours per year—time that can be reinvested into strategic work instead of administrative tasks.

4. A Better Experience for Employees

Automated payroll creates consistency:

- Paychecks arrive on time

- Calculations are accurate

- Transparency improves with clear records

When payroll “just works,” employees stop worrying about it—and that’s exactly how it should be.

Why This Matters Now

As businesses scale, manual payroll doesn’t scale with them. What worked for five employees becomes a liability at twenty—and a disaster at fifty.

AI-powered payroll isn’t about replacing people. It’s about removing repetitive, high-risk tasks so teams can focus on what actually matters: growing the business and supporting employees.

That’s exactly why PayrollRobot was built—to eliminate the hidden costs of payroll and replace them with confidence, accuracy, and speed.

Final Thoughts

Manual payroll may look cheap on paper, but the hidden costs tell a different story. Errors, compliance risks, lost time, and damaged trust add up fast.

AI doesn’t just make payroll faster—it makes it safer, smarter, and scalable.

If payroll still feels stressful, it’s a sign the system—not your team—is holding you back.

Comments are closed