Payroll is not a single task.

It’s a workflow — involving HR inputs, validations, approvals, calculations, and compliance.

When any part of this workflow is manual, delays and errors creep in.

That’s why modern businesses are adopting payroll workflow automation — to make payroll predictable, accurate, and scalable.

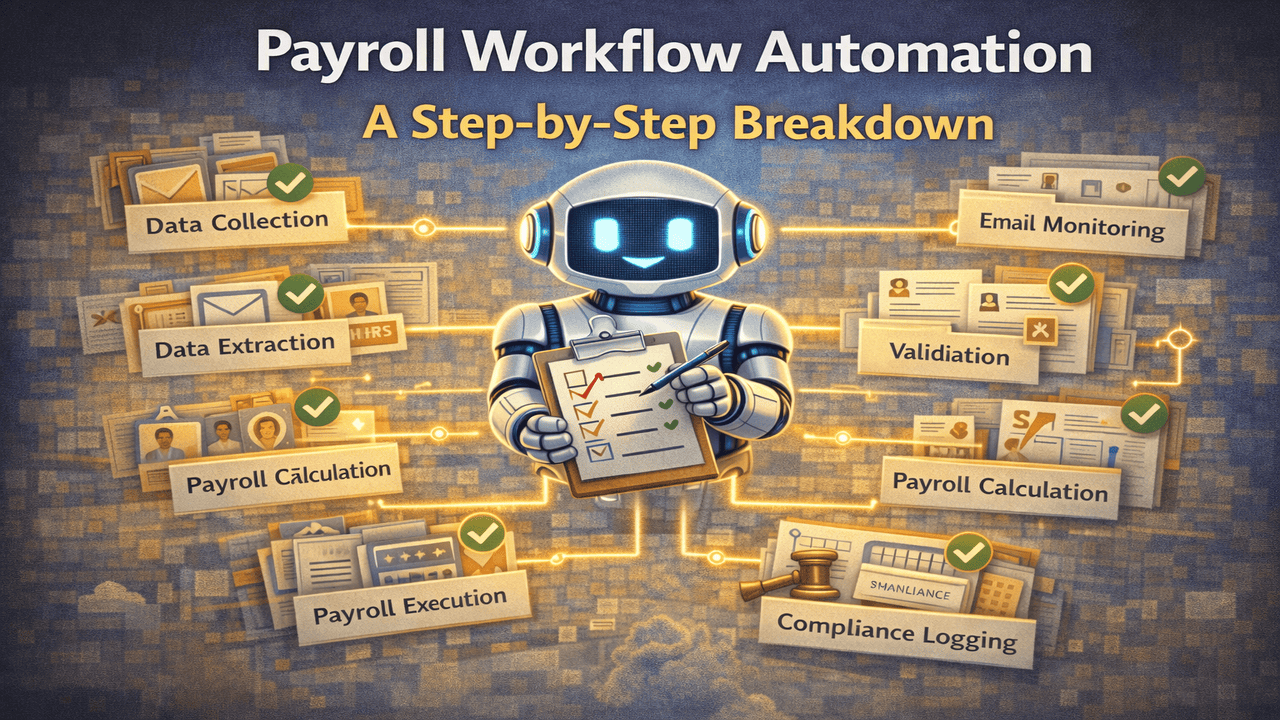

Let’s break down how payroll workflow automation works, step by step.

🧠 Step 1: Continuous Data Collection (Not Just Payroll Day)

In traditional payroll systems, work begins only when payroll day arrives.

In automated workflows, payroll data collection is continuous.

Automation systems monitor:

- HR inboxes

- Employee emails

- Leave requests

- Deduction instructions

Payroll preparation happens in the background, long before payroll is run.

📩 Step 2: Automatic Email & Input Monitoring

Most payroll data arrives through emails.

Payroll workflow automation uses AI to:

- Read HR and employee emails

- Identify payroll-related information

- Categorize requests (leave, deductions, approvals)

No email gets missed.

No information stays hidden in inboxes.

🧾 Step 3: Data Extraction & Structuring

Payroll data often arrives unstructured:

- PDFs

- Images

- Free-text emails

Automation systems extract:

- Employee details

- Dates

- Leave types

- Deduction values

This data is converted into structured, payroll-ready inputs automatically.

✅ Step 4: Validation Against Rules & Policies

This is where automation truly shines.

Automated payroll workflows validate:

- Sick leave certificates

- Leave dates vs attendance

- Deductions vs company policies

- Data completeness

If something doesn’t match, the system flags it before payroll runs.

⚠️ Step 5: Exception Handling (Humans Only Where Needed)

Automation does not eliminate humans — it protects them.

Only exceptions are surfaced to HR:

- Missing certificates

- Conflicting dates

- Policy violations

Instead of reviewing everything, HR reviews only what matters.

💰 Step 6: Payroll Calculation & Adjustments

Once inputs are validated:

- Salaries are calculated

- Deductions are applied

- Adjustments are finalized

Because data is already verified, payroll calculations run smoothly — without last-minute fixes.

⚖️ Step 7: Compliance & Audit Logging

Every automated action is logged:

- Who approved what

- When validation happened

- Why deductions were applied

This creates a complete audit trail, ensuring compliance without extra effort.

🚀 Step 8: Payroll Execution & Reporting

Payroll is executed with:

- Minimal risk

- Maximum accuracy

- Clear reporting

Founders and finance teams gain visibility without micromanaging payroll operations.

📈 Why Payroll Workflow Automation Matters

Businesses using payroll workflow automation experience:

- Fewer payroll errors

- Faster payroll cycles

- Reduced compliance risk

- Less HR burnout

- Better employee trust

Payroll becomes a system, not a recurring headache.

🧠 Final Thoughts

Payroll problems don’t come from bad intentions — they come from broken workflows.

Payroll workflow automation fixes the root cause:

- Manual dependency

- Fragmented data

- Late validations

Automation turns payroll into a reliable, scalable process.

🤝 Automate Your Payroll Workflows with Payroll Robot

Payroll Robot uses AI agents to automate payroll workflows end-to-end — from email monitoring and validation to deductions and compliance.

Because payroll should run smoothly, every time.

Comments are closed