Payroll is one of the most essential business functions—but it’s also one of the easiest places for errors, delays, and compliance issues to occur. Many businesses still rely on manual payroll processes, while others have moved to automated payroll systems powered by modern technology and AI.

So which approach is better?

In this blog, we compare payroll automation vs manual payroll across the three most critical factors: cost, accuracy, and time—and explain why more businesses are switching to automation.

What Is Manual Payroll?

Manual payroll involves calculating employee wages, taxes, deductions, and benefits by hand—or using spreadsheets and basic accounting tools. HR or finance teams are responsible for every step, from data entry to compliance checks.

While this approach may seem cost-effective initially, it often becomes unsustainable as a business grows.

What Is Payroll Automation?

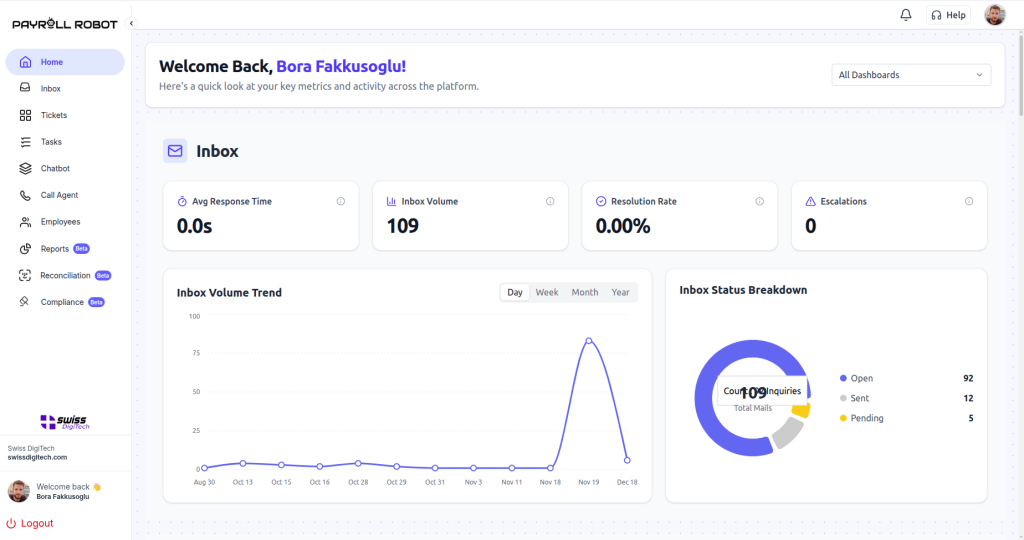

Payroll automation uses software—often enhanced with AI—to handle payroll calculations, tax compliance, reporting, and payments automatically. These systems integrate with HR and accounting tools to reduce manual input and eliminate repetitive tasks.

Modern solutions like Payroll Robot take automation even further by identifying errors, ensuring compliance, and adapting to complex payroll scenarios.

Cost Comparison: Manual Payroll vs Payroll Automation

Manual Payroll Costs

- Labor-intensive processes requiring dedicated staff time

- Higher risk of costly payroll errors and tax penalties

- Ongoing costs related to corrections, audits, and rework

Hidden costs add up quickly—especially when payroll mistakes affect employee trust or lead to compliance fines.

Payroll Automation Costs

- Predictable software subscription pricing

- Minimal ongoing manual effort

- Fewer penalties and corrections due to built-in compliance checks

Winner: Payroll Automation

Automation reduces long-term payroll expenses by minimizing errors and freeing staff time for higher-value work.

Accuracy Comparison: Manual vs Automated Payroll

Manual Payroll Accuracy

Manual calculations and data entry increase the likelihood of:

- Incorrect wage calculations

- Missed deductions or tax updates

- Inconsistent payroll records

Even small mistakes can have serious legal and financial consequences.

Automated Payroll Accuracy

Automated payroll systems:

- Apply rules consistently across all employees

- Detect anomalies before payroll is processed

- Update tax and compliance rules automatically

AI-powered platforms like Payroll Robot can proactively catch issues before they turn into costly errors.

Winner: Payroll Automation

Time Comparison: How Long Does Payroll Take?

Manual Payroll Time Investment

Manual payroll often requires:

- Hours (or days) of preparation each pay cycle

- Re-checking calculations and approvals

- Additional time to fix post-payroll errors

As headcount grows, payroll processing time increases dramatically.

Automated Payroll Time Savings

With payroll automation:

- Payroll runs in minutes instead of hours

- Repetitive tasks are fully automated

- Teams spend less time reviewing and correcting data

Winner: Payroll Automation

Manual Payroll vs Payroll Automation: Side-by-Side Summary

| Factor | Manual Payroll | Payroll Automation |

|---|---|---|

| Cost | High hidden costs | Predictable, lower long-term cost |

| Accuracy | Error-prone | Highly accurate with built-in checks |

| Time | Time-consuming | Fast and efficient |

| Scalability | Poor | Excellent |

| Compliance | High risk | Automated compliance |

Why Businesses Are Moving to Payroll Automation

Businesses today need payroll systems that are:

- Scalable

- Compliant

- Error-resistant

- Time-efficient

Manual payroll simply can’t keep up with modern demands. Automated solutions—especially AI-driven platforms like Payroll Robot—offer a smarter, more reliable alternative.

Final Verdict: Payroll Automation Wins

When comparing cost, accuracy, and time, payroll automation clearly outperforms manual payroll. While manual processes may work for very small teams, they quickly become a liability as businesses grow.

If your organization wants to reduce payroll errors, save time, and improve compliance, payroll automation isn’t just an upgrade—it’s a necessity.

🚀 Payroll Robot helps businesses run payroll smarter, faster, and with confidence.

Learn more at https://payrollrobot.ai

Comments are closed